Research group IBON said that the Duterte administration can use revenue generated by its regressive Tax Reform for Acceleration and Inclusion (TRAIN) law to fund emergency cash assistance. TRAIN’s new taxes increased the prices for goods and services consumed by the majority poor Filipinos even amid the pandemic and the revenues can be used productively while the law remains. This is making the best out of a bad thing, IBON said.

Up until last year, the TRAIN law allotted ₱36 billion for temporary unconditional cash transfers to the country’s poorest 10 million households at ₱3,600 each for the whole year. This was a stratagem to cover-up the grossly regressive nature of the law, said IBON, but is no longer being given after 2020.

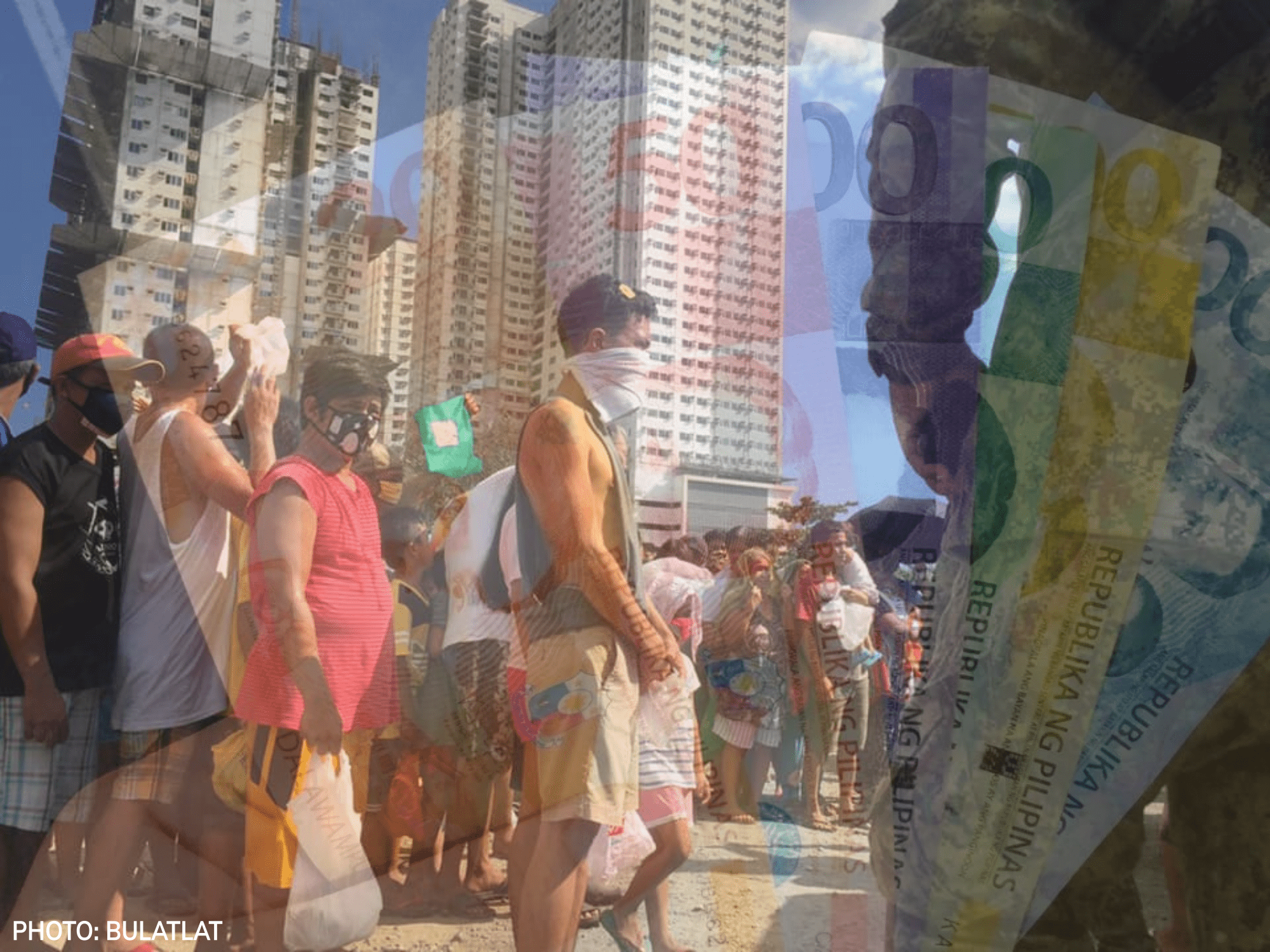

IBON said that this is ₱36 billion that should immediately be allotted for giving additional ayuda especially amid the new round of stricter community quarantines in the National Capital Region (NCR) and elsewhere.

The additional revenues the TRAIN law has generated since being implemented in 2018 actually gives even more scope for ayuda to the poorest families. It is projected to raise ₱133.9 billion in revenues in 2021. The largest part of additional revenues comes from changes in petroleum taxes (₱105.7 billion), sweetened beverages (₱43.4 billion), and value-added tax (₱29.3 billion).

These are indirect consumption taxes that disproportionately burden poor and low-income Filipinos the most. IBON said that to the extent that they are taken from currently distressed families, then it is only proper that the government returns this to them as ayuda.

The case for this is strengthened by how TRAIN in effect already supports the incomes of higher-income groups. It lowers personal income, estate, and donor’s taxes paid this year by ₱152 billion, ₱2.1 billion and ₱2.2 billion, respectively. IBON points out that these cuts in direct taxes are going wholly to the country’s highest-income families especially those earning above ₱250,000 annually.

In contrast some 15 million families, or six out of ten Filipino families, earning below this threshold are actually worse off under TRAIN in paying higher indirect consumption taxes without compensatory gains from lower direct taxes, stressed IBON. The tax-driven erosion of household incomes of the poorest was unconscionable before but even more so now amid the lockdown-driven collapse in incomes and livelihoods.

TRAIN made petroleum products and sugary drinks more expensive with a further inflationary effect on the prices of food, transportation and electricity. Inflation is worst for the bottom 30% of the population as it is, increasing from 2.9% in July 2020 to 4.4% in July 2021, with food inflation in particular accelerated from 1.5% to 4.2% over that same period.

Because of TRAIN’s additional oil excise taxes, LPG is now more expensive by ₱6 per kilo, diesel by ₱6 per liter, kerosene by ₱3 per liter, and gas by ₱10 per liter. The new excise taxes on sweetened beverages are at ₱6-12 per liter of volume capacity.

These are undue burdens on the poor especially amid the current economic crisis, said IBON. A short-route jeepney driver, for example, now pays ₱73.92 more for 11 liters of daily diesel, or up to ₱2,218 more every month. Farmers pay ₱1,277 more for 190 liters of diesel per hectare every harvest season. Households using LPG for cooking have to pay at least ₱36.96 more per 11-kilo tank.

Sweetened beverages can account for as much as 80% of sari-sari stores’ sales. IBON noted that the prices of items commonly bought by ordinary low-income families have soared: a powdered juice drink sachet that makes 1 liter priced at ₱7 pre-TRAIN now costs ₱22; a 250ml juice tetra pack that cost ₱14 pre-TRAIN now costs ₱20.

The Duterte administration has no reason to keep saying that it does not have the money for additional ayuda, IBON said. The government’s TRAIN tax reforms have raised revenues albeit in a grossly regressive manner placing a disproportionate burden on the poorest and most vulnerable households. At the same time TRAIN reduced the tax burden on high-income families including the country’s wealthiest, while its recent Corporate Recovery and Tax Incentives for Enterprises (CREATE) law cut income taxes on large corporations and foreign firms.

IBON stressed that the tax system urgently needs to be made fairer, more equitable and progressive. In the meantime, the revenues being generated should be directed towards those most in need starting with critical ayuda to mitigate the impact of the government’s repeated strict lockdowns, said the group.

0 Comments